Do Mutual Banks Have a Digital Advantage?

In brief

Australian mutual banks and credit unions are facing an unprecedented opportunity, driven by the Banking Royal Commission, introduction of the Consumer Data Right (CDR), and the accessibility of cloud technologies.

These changes could enable community-oriented banks to grow their Millennial and Generation Z (Gen Z) membership, where these groups tend to be more socially conscious than previous generations.

To realise this opportunity, we recommend building trust into digital services; leveraging artificial intelligence (AI) technologies to personalise experiences; and embedding new ways of working to learn faster.

Three Trends Driving Disruption in the Australian Financial Sector

Australian mutual banks and credit unions are facing an unprecedented opportunity driven by three factors.

First, The Hayne Royal Commission has been followed by a reduced level of trust in the Big 4 banks, whereas community-oriented banks have emerged largely unscathed. In 2019, the loan portfolio of mutual banks grew 7 percent. In contrast, the Big 4 reported a growth rate of 1.7 percent. A recent survey found that mutual banks and credit unions generally had higher net trust scores, with Bendigo Bank and P&N Bank scoring the highest at 22 points, while the Big 4 achieved between 8 and 11 points.

Second, the CDR legislation that came into force in 2020 will enable mutual banks to better understand future members. Accredited Data Recipients (ADRs) will be able to access data from other banks, which they may use to personalise offers and services, subject to consent. Currently, customers of the four major banks can share their banking data from a range of personal accounts (for example, savings accounts and term deposits), as well as home loans and personal loans, with other authorised deposit-taking institutes (ADIs) having to make this information available in phases commencing in July 2021. A November 2020 survey of Australian financial services organisations found that 71% intended to use data obtained through the CDR - 58% within the next 12 months.

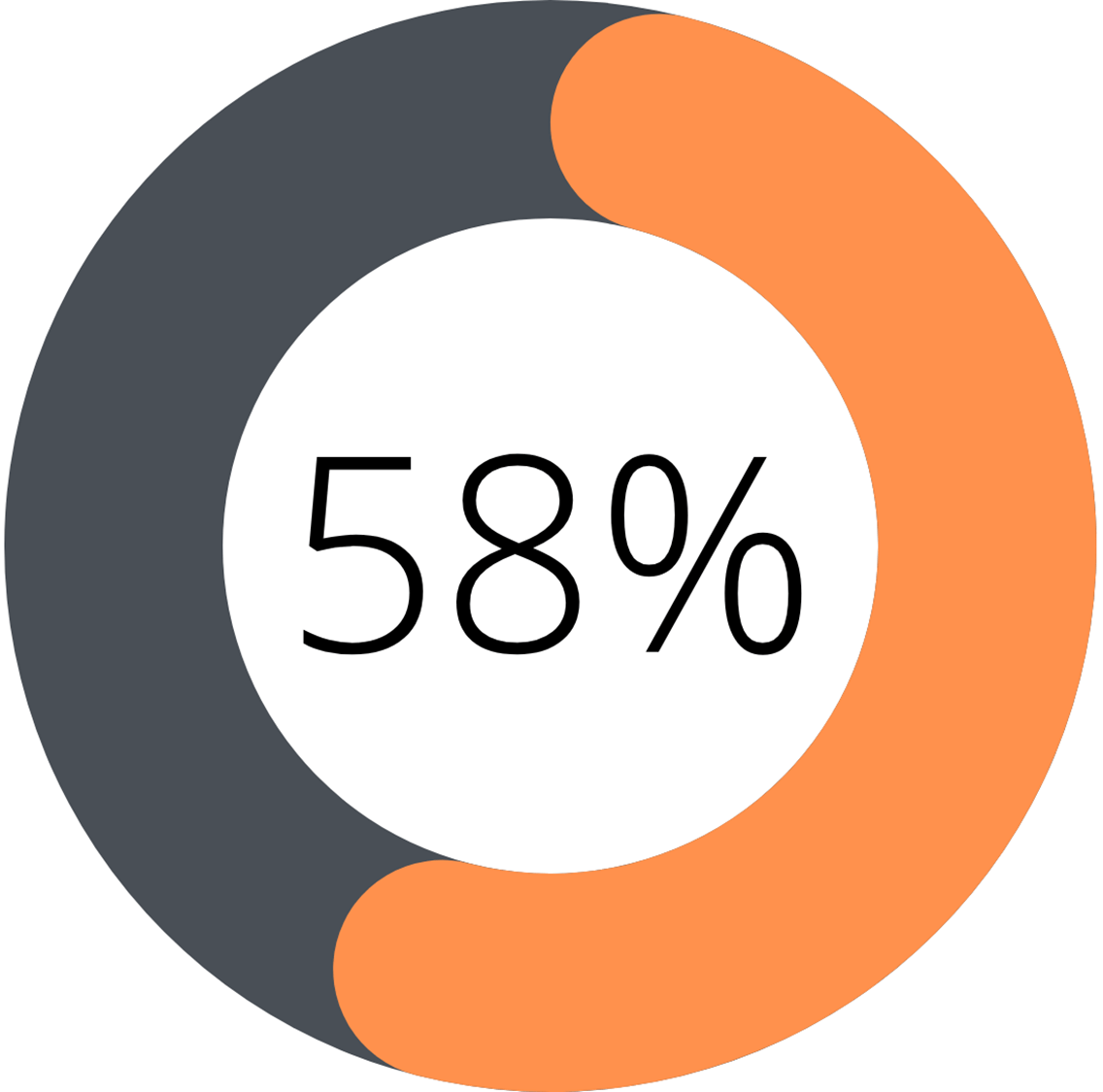

Third, the accessibility of cloud services means that mutual banks and credit unions can trial sophisticated AI technologies at a fraction of their cost a few years ago. Typically, organisations experimenting with high-performance computing would have invested millions of dollars acquiring technology. Nowadays, AI applications can be prototyped in days or weeks using turnkey cloud services, allowing organisations to validate them cheaply and quickly. The leading cloud vendors offer incentives for organisations to adopt cloud technologies, such as free usage tiers, discounts for early adopters, and the ability to use software licenses to access equivalent services on the cloud. A survey carried out in 2020 found that the average bank already has 58 percent of its workloads in the cloud.

Organisations intending to use data obtained through the CDR

Percentage of workloads in the cloud for the average bank

Engaging Millennials and Gen Zs

To protect their future, mutual banks and credit unions will have to develop strategies to attract and service Millennial and Gen Z members. Millennials - born between 1981 and 1996 - comprise around 6 million or 23% of Australia’s population, while Gen Z - born after 1996 - represent around 4 million or 16% (2 million over 18 years old).

Representation of Millennials and Gen Zs in Australia

Community-oriented banks and credit unions provide a compelling alternative to the Big 4 for these cohorts, who tend to be more socially conscious than previous generations. A recent survey found that 41% of Millennials and 52% of Gen Z wanted to make a positive impact in their community or the world at large. More than 40% reported they had deepened a business relationship because they believed a company’s products or services to have a positive impact on society and/or the environment, and 77% said they had stopped or lessened a business relationship because of the company’s ethical behaviour.

To effectively engage with these groups, mutual banks and credit unions should consider strategic investments in digital capability. Almost 90% of Gen Z admit to being online almost constantly or at least several times a day, and Millennials are not far behind. A survey of Australians found that 79% want their information to be seamlessly integrated across all points of contact. Banking customers particularly value personalisation, with 88% saying it is important for their financial institution to provide recommendations relevant to them based on their product usage and behaviours, similar to Amazon and Netflix.

Millennials and Gen Zs who have quit a relationship because of ethics

Banking customers who would like more personalisation

We recommend three strategic actions for mutual banks and credit unions to protect their future.

Build Trusted Digital Services

We believe that community-oriented banks should go further than becoming an ADR by building trust into digital services. A 2019 survey showed that people were more willing to share banking transaction information with organisations in which they had a high level of information trust. Consumers – particularly Millennials and Gen Zs – may expect organisations to go over and above regulatory requirements in using their information ethically.

Mutual banks and credit unions could protect their status as trusted organisations by building optionality into digital services in relation to the storage and use of member information. This concept has largely been adopted by social media companies, like Facebook and Google, who have responded to public pressure by embedding customisable privacy settings in products.

Our recommended actions for community-oriented banks are as follows:

Develop a deep understanding of member expectations regarding AI ethics and data privacy – particularly Millennials and Gen Zs

Provide a catalogue of services through digital channels for members to opt in or out of, clearly describing how their information would be used and how they would benefit

Design digital services with self-configuration capabilities that automatically reflect members’ privacy choices

Implement controls to enable transparent reporting to stakeholders on the organisation’s adherence to AI ethics and data privacy policies

Leverage AI to Personalise Digital Experiences

With a foundation of trust that enables mutual banks and credit unions to access data from other institutions, they will be able to better engage with existing and potential members. For example:

Making personalised offers to attract and/or retain members

Delivering frictionless onboarding experiences

Providing intelligent budget and expense management services

A number of the major banks already use AI technologies to create personalised experiences for their customers. These work by ingesting and aggregating customer data from multiple sources; using machine learning algorithms to predict customer behaviours; and recommending the next best intervention to improve engagement and conversion rate for each individual.

We recommend the following actions for community-oriented banks to develop personalisation capability:

Implement a personalisation platform to acquire and integrate large volumes of fast-moving data, both from external and internal sources

Build a single view of members by aggregating data from digital and physical channels, while continuously improving the quality of data in the organisation

Leverage the single view of members to understand complex behaviours and enable continuous experiences across all points of contact

Develop personalised experiences, using explainable and trusted AI solutions to predict the next best action to take with each potential or existing member

Embed New Ways of Working

While the major banks are making substantial investments in digital capability, we believe that the mutual banks and credit unions could move faster than them. These organisations tend to have lower complexity of products and systems than the Big 4, who must integrate new capabilities with their legacy environments. Many community-oriented banks also have collegiate cultures where decision-making is comparatively agile.

In addition, mutual banks and credit unions may consider embedding new ways of working that enable them to test product and service ideas faster. As a case in point, after ING started its agile transformation in 2015, they saw multiple point increases in customer-satisfaction and employee-engagement scores and have moved from having five to six software releases per year to every two weeks.

Our recommendations are:

Consider organising product and technology functions into virtual teams (“squads”) that are focused on improving a particular aspect of the member experience

Move from a linear system delivery lifecycle to an iterative approach, where incremental digital capabilities are released in weeks, not months or years

Use technologies and tools that support new ways of working, including cloud services and software collaborations and development (DevOps) tools

Consider co-developing digital products and services with mutual banks and credit unions that service different market segments

In summary

Mutual banks and credit unions should consider strategic investments in digital capability that build trust into digital services, develop personalisation capabilities, and embed new ways of working. We believe that implementing these changes will enable community-oriented banks to access consumer data and use it to better attract and retain Millennial and Gen Z members.

Insights

About Cognis

Cognis helps organisations to transition to an AI-powered future.

We equip and enable you to harness the power of AI to create new revenue streams, reimagine customer experiences, and transform operations.

NEWSLETTER

Sign up to our newsletter.

©Cognis Pty Ltd